Can I get a mortgage on this Condominium?

Here are three basic facts about condo and co-op lending in 2024. These terms would supersede any Washington’s Condominium Act RCWs :

- Fannie Mae and Freddie Mac’s new lending guidelines are meant to ensure that homeowners are made aware of possible structural and mechanical issues in the buildings they own or are buying units in.

- All condo’s with more than 5 units are impacted by the release of these guidelines. No longer will they be able to claim hardship or size exclusion.

- For mortgage financing to be available to borrowers in condo and co-op properties, property managers and board members must immediately do several things: adopt new reserve funding policies, abandon the special assessment repair funding method, complete needed structural and mechanical component repairs, and obtain an onsite inspection and/or reserve study to determine component condition and capital requirements.

- Appeal Process for Ineligible Projects – There’s now a formal process for condo associations to appeal a project being deemed ineligible for financing by Freddie Mac

In January 2022, Fannie Mae rolled out new temporary guidelines for lending in condo and co-op properties in response to the tragic collapse of the Champlain Towers condominium in Surfside, Florida, that took 98 lives. So far, the new guidelines have had a massive impact on borrowers, lenders, condo and co-op boards.

The focus of these new guidelines is squarely on ensuring that Fannie Mae and Freddie Mac do not lend on properties that are unsafe — and equally important, to ensure that associations have enough capital to repair problems that may exist. While these new guidelines create more transparency into the condition and financial health of condo and co-op properties, they have wreaked havoc on lenders trying to comply with these new directives for lending.

Who Does This Affect?

Any Association legally recognized as a “condominium” or a “cooperative” with more than five units. The word “condominium” is important, as there are Associations that may be perceived as a “town home;” however, they might be legally defined as a “condominium.” The word does not just apply to what one might envision as a high- or low-rise building. Check your Declarations and Articles of Incorporation for this definition and classification of your Association.

Reserve Study & Funding – A reserve study will satisfy most of the requirements as long as the association is following the recommendations laid out in that study. Fannie and Freddie both require that 10% of operating budget goes to Reserves. (note: Fannie waives this requirement if a reserve study is in place and up to date).

New Reserve Requirements

Fannie Mae and Freddie Mac’s newest guideline change has an increased focus on requiring condo and co-op boards to maintain a 10% or greater reserve line item for future maintenance. Although this requirement has been in place for years, the 10% reserve line-item has often been left out of condo and co-op budgets so unit owners could enjoy lower monthly dues. Some condo and co-op boards have flat-out refused to add the reserve line item to their operating budget.

Freddie Mac seems to be more reasonable on this issue, as the agency still accepts a reserve study to outline appropriate and accurate reserve funding in lieu of the 10% reserve line item.

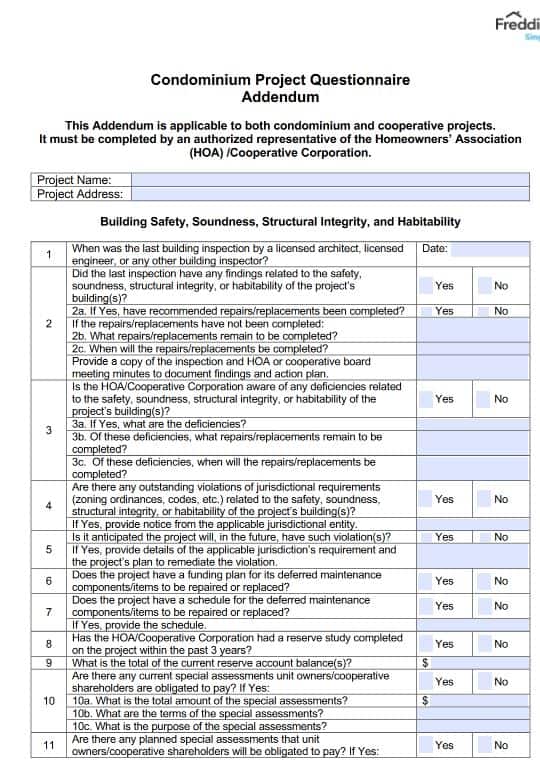

New Questionnaire

A new 3-page addendum to the existing questionnaire is the result of Champlain Towers. Of primary concern are the following questions in the addendum (edited for brevity):

- When was the last building inspection by a licensed architect, licensed engineer, or any other property inspector, and did the last inspection have any findings related to the safety, soundness, structural integrity or habitability of the buildings?

- Is the association aware of any deficiencies related to the safety, soundness, structural integrity, or habitability of the buildings?

The starkest difference from the pre-addendum questionnaire is that now banks are asking Associations to make affirmative representations about the structural soundness of the buildings, whereas in the past, Associations were simply providing information about the property, and the lender could make its own determinations. It’s safe to assume that lenders will seek to hold boards accountable if an affirmative representation proves incorrect.

For further information, see Fannie Mae’s selling guide.

Being compliant means that these properties meet several key criteria, which includes establishing a reserve account that has a substantial amount of capital to pay for future repairs and replacement of common area mechanical and structural components.

Compliant properties also have a current reserve study . This ensures board members and property managers are informed of the condition of different components, that reserves are appropriately being collected in an annual operating budget, and that future repair and replacement costs are being collected to avoid future special assessments. Compliant properties also have a baseline questionnaire that has been completed for the property which addresses the new questions that the GSEs require to be answered, either by attaching an updated reserve study, engineers report, or equivalent for review.

The Bottom Line

At the end of the day, there is no longer any way for a condo or co-op property to operate without reserving adequate capital for component repairs. If they do not comply with the new guidelines, financing will not be available … period. From now on, buildings must obtain professional evaluations of components, set aside appropriate funds for future capital repairs and complete repairs to components whose maintenance has been delayed or overlooked. For many condo and co-op lenders, the best response to this new reality will be to look for outside expertise to help.

Otherwise, we can only hope the new reality created by the GSEs’ guidelines—as challenging as they are—will introduce a new era of more transparent, proactive, and safer condo and co-op properties. CAI has a great booklet on this